Is the Housing Market an "SHTF Moment?"

July 11, 2022

By Dawn Pfaff, Host of Go Home TV & President of My State MLS

The sky is falling! Or so you would think with the numerous Doomsday scenario videos and articles.

Social media is abuzz that the housing market is going to crash, but will it really?

After hearing this dreaded news repeated several times in YouTube videos and Facebook posts, and because I'm an evidence-based person, I decided it would be best to check it out myself to see what's really happening in the housing market.

Everywhere I looked I saw a lot of talk about the market slowing down and "I'm not getting multiple offers fast enough." However, getting multiple offers in a matter of hours of posting a listing is not normal, even though it truly happened in the last few years.Right now, there isn't a lot of inventory and that's the problem. Not having inventory is not normal for the market.

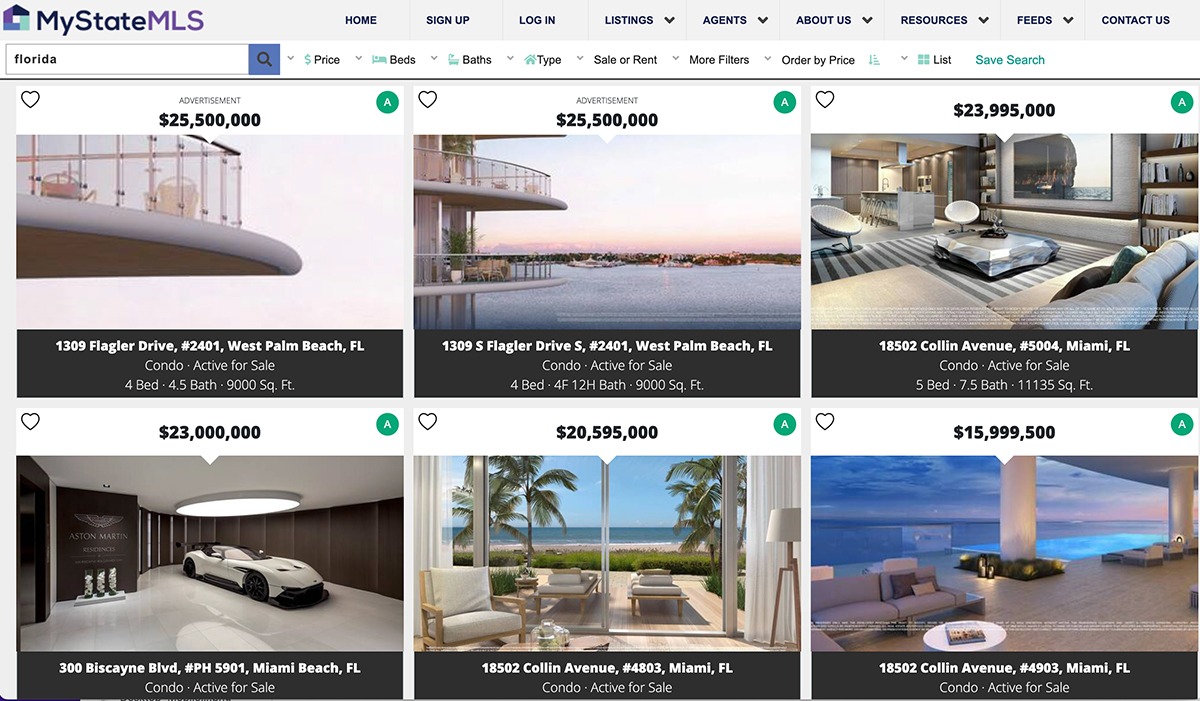

To decide whether the online panic is real or inflated, I took ten markets across the country to compare to see what's really happening in them. I looked at New York City and the eastern part of Long Island, which is Suffolk County, Las Vegas, Memphis, Detroit, Boise, Chicago, Miami, Tampa, and Palm Beach County, and what I observed was quite interesting.

Before I get into the results of my investigation, let me take a quick moment to explain what data I was looking at and how I got to my conclusions. The first data point was how many houses are for sale that aren't pending compared to how many are pending. Pending means that there's a contract on the house or that a contract is about to close. Then I looked at the total days on market or how long it took to from list to sell date. Once I had those numbers, I measured how much it changed from the previous year.As of this post and video, none of these ten markets have had negative price growth. All of them are on the positive side. But the variable to keep in mind is that we are comparing the data from a year ago when interest rates were still very low.

Of these ten markets examined and out of all of the northern markets I analyzed, Suffolk County was the most positive market, and with so many people looking to leave the city, I expect the SuffolkCounty market will continue to rise, even if it isn't at the same rate as last year.

The market closest to falling, at the time of this post, is Chicago. It has the lowest price change year over year at 1.6% and the pending to active listings are almost a one-to-one ratio.

The weakest growth was in New York City. Admittedly, this surprised me. When I started looking into the markets, my first assumption would be that Detroit and Chicago were going to be weaker ingrowth than New York City, but the New York City market has remained stagnant and has the second smallest percentage of price increase over the last year.

During the summer months, when the northern markets are most active, New York City would typically be in an appreciating market. Now, while it's not in a down market, it's not on fire either. It's the most normal of all the markets that I looked at.

Compare that to Palm Beach County, which is out of season at the time of this analysis. It has had a25% price change over the last year.Right now, Miami, Tampa, and Palm Beach are still strong markets even in the slowest time of year for them, which means that when the busy time comes it should remain strong.

And, of course, the housing market is going to have a direct impact on the rental market. With prices still relatively high in the housing market and the lack of vacant rental properties, rental prices will continue to rise until more units are built and competition can level out the market.

The city of West Palm Beach has passed an ordinance that states, if there is a rent increase of more than 5%, landlords will need to let tenants know at least 60 days in advance. This won't curb the crushing costs of renting but at least will help tenants figure out their budget or decide if they should buy a home.

More "good news" on that front is Fannie Mae will consider the most recent 12-months rent payment histories towards its automated creditworthiness check system. This should help more people get out of the rent cycle and into home ownership.