Advice from the Mortgage Mom Deanne Katsaros

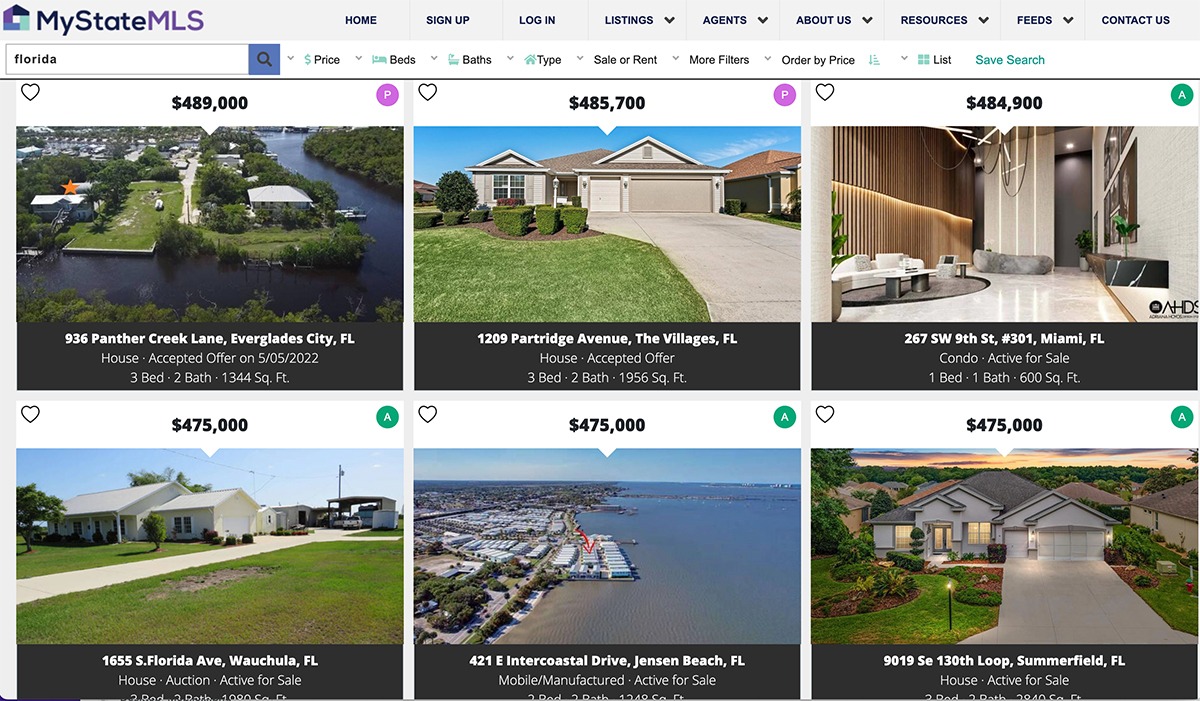

By R. Michael Brown, Go Home TV Producer & Dawn Pfaff, Go Home TV Host & president of My State MLS

Deanne Katsaros, owner of Greentree Mortgage Company, came to the Real Estate Cellar to talk to us about loans, mortgage loans, and how she helps buyers get into homes.

"They call me the mortgage mom because I basically treat my clients like family," said Deanne. "Mortgage mom just came about because if somebody is not able to purchase a home now, we're able to take them through the process. So it might be credit, it might be assets, it might be budgeting. I'm holding their hand through the entire process, that's all."

Deanne has a radio show out of Philadelphia and has over 3 million listeners called Good News and Real Estate. It's been on the air for 13 years, over 925 episodes.

Mortgage Mom Deanne Katsaros & Mark Cumberland on Good News Radio Show WPHT Philadelphia

She has also been on HGTV to show the home buying process from beginning to end, including walking into the house with the buyer, going through the loan process, and taking the buyer all the way to closing.

Greentree is a direct lender, which means they fund mortgage loans with their own money.

"That makes me a mortgage banker," said Deanne. "Now, if I was a mortgage broker, I would be going out to five, six or seven different companies and shopping around for the best product. I'm not a fan of that. My company does an amazing job. So being an in-house lender gives us the opportunity to do everything in-house."

As a banker, Deanne has more flexibility and is able to meet tough deadlines and quickly resolve issues directly with the home buyer.

"It's a lot easier for you to control that process and say, you know what? I don't want them to lose their earnest money," said Dawn.

The current mortgage rates today, as shown on sites like BankRate.com, will have an impact on what you'll pay each month and for the life of your loan. Also your credit, how much downpayment you plan on providing, and if you're going to apply for a 30-year fixed mortgage.

Many home buyers find that getting a mortgage is the hardest part of the process. Decisions have to be made about what are the current interest rates depending on how I'm financing, should I go for an adjustable rate mortgage (ARM) as interest rates for homes increase?

"It can be a scary," said Dawn. "I always think about the customer that puts down every last dollar they had - thousands of dollars for earnest money. Right? And if they don't close on or before the closing date, they could lose it all."

"Correct," said Deanne. "I've been working with my underwriter for 15 years. We have a routine. We're like family. So we take care of our clients and help get them to closing."

It's tough to find a home right now and even tougher when competing with cash buyers for the few homes that are for sale.

"This has been a game changer," said Deanne. "You have first time homebuyers that want to have their dream home, only to go out and put five, six, seven, maybe even ten offers in on properties and [those] offers get denied, beat by cash buyers. We try to level the playing field. I have an investor that I'm working with personally that has allowed us to put in offers as cash. And he backs that offer with cash."

Cost to the buyer is a 1% fee of the purchase price of the home. If it's a $400,000 house, this cash service costs the home buyer $4,000 up front.

"When you go to put your offer in, we're sending a proof of funds letter," said Deanne. "We're checking the box that's waiving the mortgage contingency. If the financing should fall through my investor is purchasing this home with their cash."

"Now, in the background, we're still getting an appraisal, said Deanne. "We're getting a home inspection for informational purposes only, and we are making sure that all the I's are dotted and the T's are crossed. They're fine. They're going through the loan process."

"At the end of the day, the seller's not worried about how we're coming to the table, said Deanne. "We come in with a bag of cash or we come in with wired funds."

The 1% fee gets you that proof of funds letter from the investor. If your offer is not accepted, then that money gets refunded to you or the investor keeps it for the next offer. But, if you get that offer and we still close with financing, the whole reason that you got that offer accepted was because you went in with cash and funds.

"This is such a very cool idea," said Dawn. "There are other companies that do this, but the way you're doing it is a lot more personal. I really like the fact that you're being very personable about it because you care about that person's money, you're not risking their earnest money deposit."

This process works for bridge loans too when you have to sell a house to buy a house. It keeps the buyer from having to carry two mortgages during the transition process from old home to their new one.

"It's not a guaranteed bridge loan," said Dawn. "But it's a tool that you have to potentially use if somebody needs it and if they qualify."

"Right," said Deanne. "We have a situation with a client who has a very small mortgage on their primary home. They want to move to another home. All of their equity in cash is locked up in their existing home. They'll get their cash as soon as they sell in this market and use it to pay off a large portion of the new mortgage."

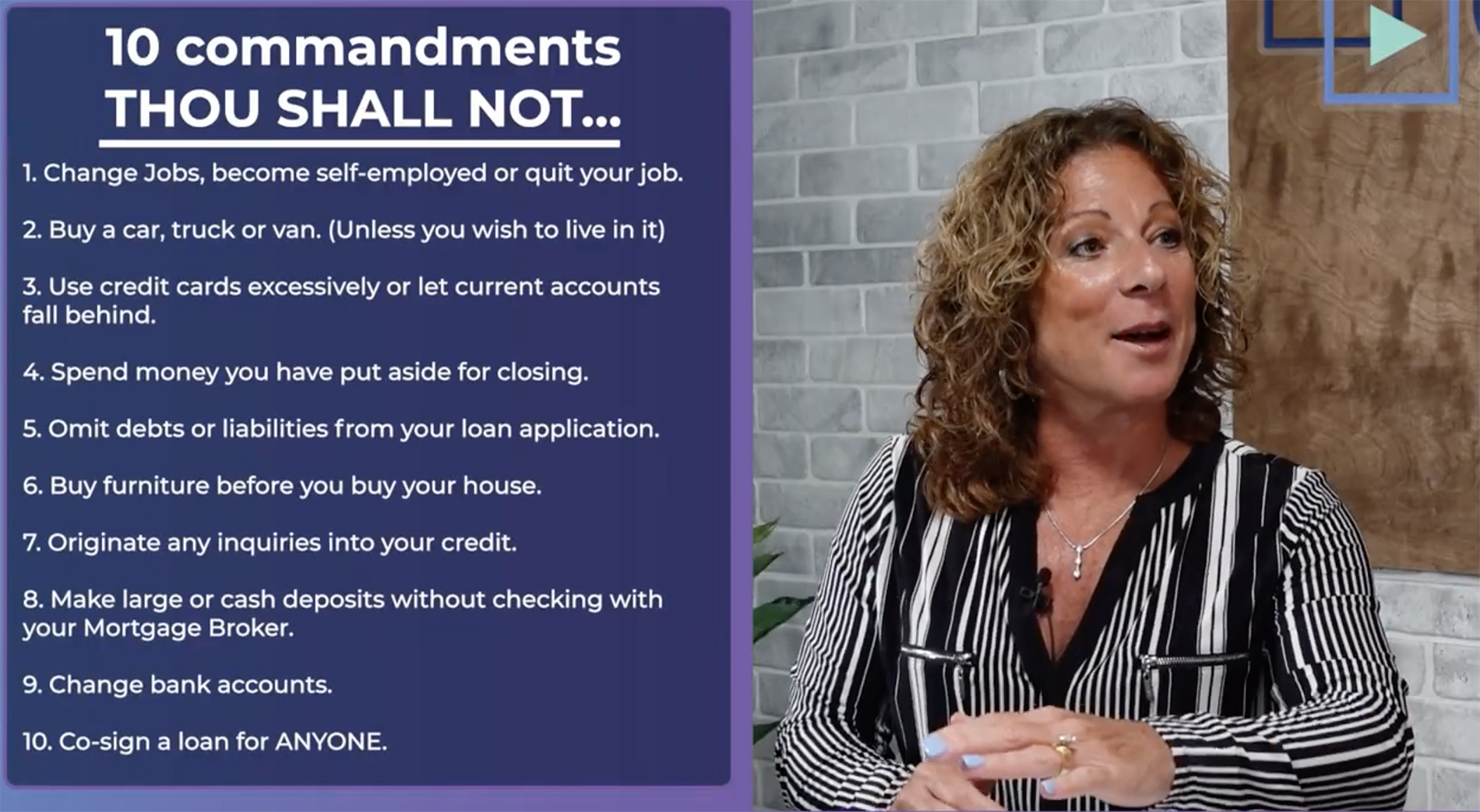

The Ten Commandments for Buying a Home

What can muddy up deals? When a buyer spends large sums of money on big ticket items or suddenly has large bank deposits that aren't backed by documentation. There's more....

"We have Ten Commandments of what not to do when purchasing a home," said Deanne. "Don't buy a car unless you plan on living in it. Don't change jobs and forget to tell me because that's how we found out. We call to do a verification of employment three days prior to closing. Don't drop ten grand in cash in your bank account one week before the closing and not have a chain of custody. the underwriter needs to know where it came from. Did you take out a loan for this? Did it change your debt-to-income ratio?"

VIDEO TIMECODE TOPIC

00:24 - 01:12 The name Mortgage Mom

01:14 - 02:20 Radio show Good News in Real Estate

02:21 - 03:17 HGTV appearance

03:23 - 05:07 Difference between a mortgage broker and mortgage banker & benefits

05:08 - 11:02 How to make cash offer on a home when you personally don't have the cash

11:03 - 12:04 Making major purchases during the home purchase process

12:05 - 13:25 Ten Commandments of everything not to do when purchasing a home

13:26 - 14:47 Difference between pre-qualified and pre-approved for a mortgage loan

15:30 - 17:51 What are USDA Loans (100% financing for rural development) & FHA Loans (not just for first time home buyers)?

17:52 - 18:45 Points and Origination Fees in a mortgage deal / closing costs

18:50 - 20:30 How to do Contingent to Cash Offers when selling one home and buying another. Bridge loans.

20:31 - 22:00 Real estate as an investment. Duplexes (multi-family) are the best way to start. House hack!