New Study Reveals Florida Dominates List of 25 Most Overvalued U.S. Rental Markets

Florida Apartments - Getty Images

Researchers: Shortage of Units Will Lead to Real Estate 'Reckoning'

May 3, 2022

By Paul Owers

Rental rates for homes and apartments have spiked across the nation, and Florida is the center of the surge, according to a new study from Florida Atlantic University (FAU) and two other schools.

The researchers ranked the 25 most overvalued U.S. rental markets, and the first five all are in the Sunshine State. South Florida heads the list, with renters in Miami-Dade, Broward and Palm Beach counties paying an average $2,832 a month - 21.75 percent above what they should be paying, based on the area's long-term leasing trends.

Fort Myers is No. 2, with a $2,052 monthly average rent - 18.16 percent above the long-term leasing trend for the area. Tampa (17.08 percent premium), Sarasota-Bradenton (16.98 percent) and Port St. Lucie (15.61 percent) round out the top five.

No. 6 Killeen, Texas (15.46 percent) is the first market listed outside Florida. Also in the Top 10: Bakersfield, California; Lakeland, Florida; Phoenix; and Knoxville, Tennessee.

Full Rankings Can be Found Here [FAU College of Business]

Stay tuned for an in-depth interview with Ken Johnson at FAU, Ph.D., with Dawn Pfaff of Go Home TV.

Our camera crew is on its way to FAU this week!

The researchers from FAU, Florida Gulf Coast University and the University of Alabama believe rents have increased sharply in Florida during the pandemic due to robust demand from out-of-state transplants. At the same time, developers have struggled to build more units because of supply-chain shortages and rising materials costs.

"Florida is a popular destination under normal circumstances, and it's even more desirable now because its pandemic policies strongly favored consumers and businesses," said Ken. H. Johnson, Ph.D., an economist in FAU's College of Business. "Landlords can charge exorbitant rents because if the existing tenants do not accept the new lease terms, other people will accept them quickly. This all points back to a persistent inventory shortage in rental units."

Johnson, Bennie Waller, Ph.D., of UA and Shelton Weeks, Ph.D. of FGCU's Lucas Institute for Real Estate Development & Finance started analyzing rental markets in Florida earlier this year before expanding the study. They use past leasing data from Zillow's Observed Rental Index to statistically model historic trends from 2014 and determine where rents should be and compare those to current rents. The difference between the two is the premium renters are paying. The higher the premium, the more overvalued a market is.

The recent rent increases are unusual because rents tend to be less volatile than housing prices, which are more reactionary to external forces, such as mortgage rate changes, according to the researchers.

"Higher rents will persist until inflation comes under control and we build enough units," Weeks said. "In the meantime, people will have to make hard choices."

To escape unaffordable housing, people used to move to the suburbs and drive farther to work, Waller said. But the cost of cars nationally has shot up 48 percent year over year, according to the Bureau of Labor Statistics, while gasoline in the U.S. Southeast has increased 51 percent during the same period, according to U.S. Energy.

"So moving to cheaper areas still involves higher costs," Waller said. "This is crippling to the average person on Main Street."

Miami-Dade County recently adopted a new ordinance that requires landlords to give at least 60-day notices for rent increases above 5 percent. Meanwhile, some housing advocates are calling for more measures such as rent control, but Johnson said restricting landlords from charging market values discourages development and leads to the poor condition of existing units.

"We want an immediate solution to this problem, but there is none," he said. "There is going to be a reckoning from this latest housing crisis."

See More [FAU College of Business]

---------

Go Home TV - Editors Note

By R. Michael Brown, Go Home TV Producer

Although the numbers are staggering, they are county averages. There are pockets that are much different than the averages.

For example anecdotally, in Palm Beach County, Florida, the rent increase has gone up 32 percent and 21.75 percent above what they should be paying. However, in the Village of Wellington in Palm Beach County, the rent increase has gone up 43%. We're sure these differences are reflected around the U.S. - remember, all markets are local.

Concerning the cost and slow process to build more units for sale and rent, in addition to the struggle to build because of supply-chain shortages and rising materials costs - labor (if the builder and get workers) costs are exploding and local, state and federal government permitting processes are getting longer and longer and costing builders more - all contributing to higher rental and sales costs.

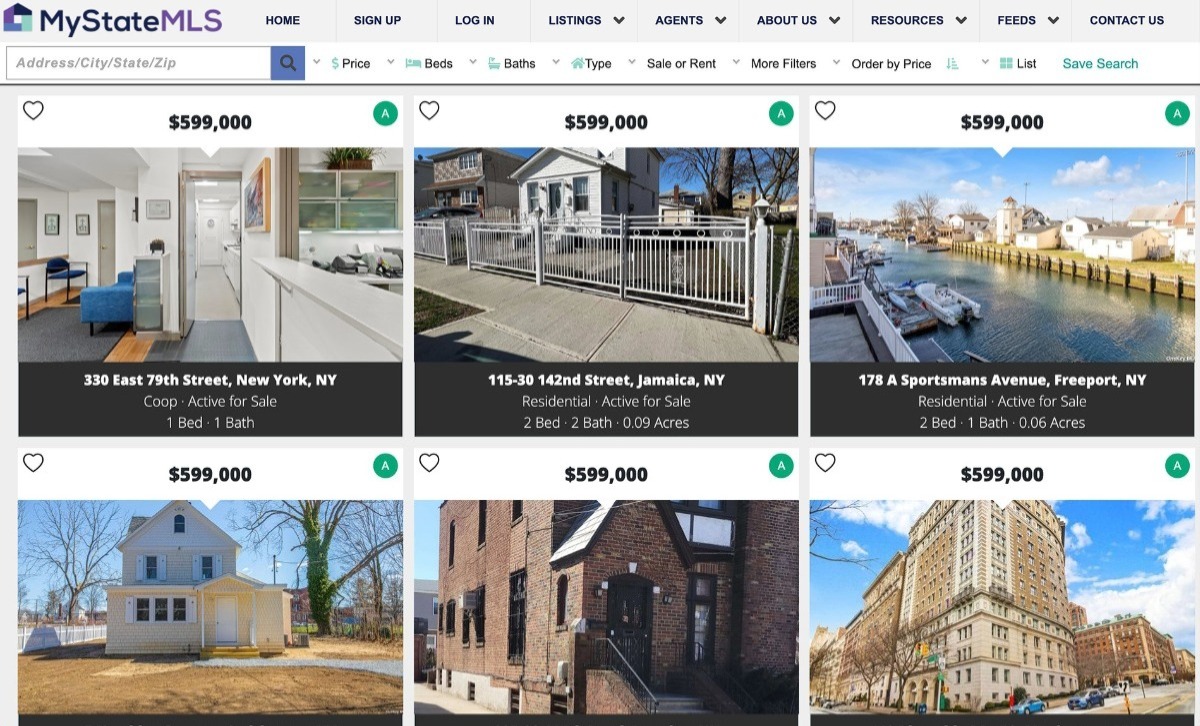

"We can build our way out of this crisis," said Dawn Pfaff, president of My State MLS. "But government agencies will have to streamline their processes so it doesn't take three to seven years or more to get through permitting before building can begin."

According to the National Multifamily Housing Council (NMHC), regulatory compliance is one of the biggest reasons for the increase in multifamily development costs, counting for a staggering 32% of overall costs. While some of these rules and ordinances are clearly necessary (i.e. basic fire safety regulations), others are often needlessly complex.

Click Here to See the Go Home TV Story About the Top 100 Housing Markets and Sale Prices