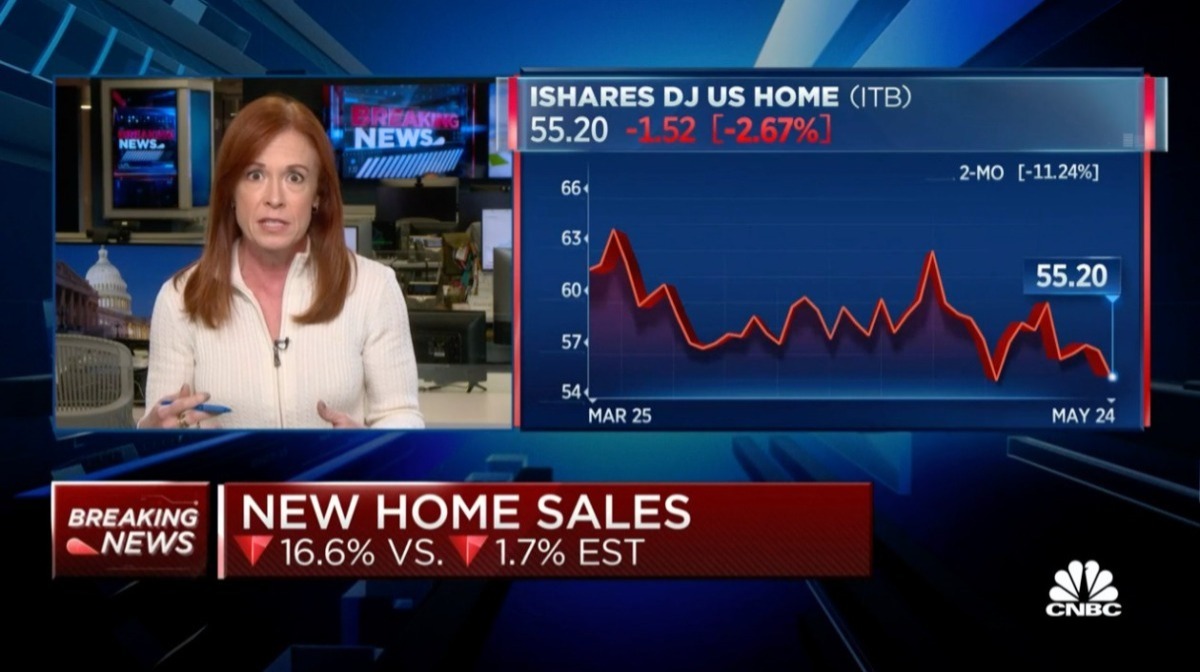

Sales of Newly Built Homes Tumbled Over 16% in April While Prices Soared

By Diana Olick, CNBC

Sales of newly built homes dropped 16.6% in April from March, far more than expected, and were down 26.9% from April 2021, according to the U.S. Census.

The annualized rate came in at 591,000 units, seasonally adjusted. Analysts had been expecting 750,000. March's read was also revised lower.

That is the slowest sales pace since April 2020, when everything shut down at the start of the Covid pandemic. Sales surged quickly after that, as Americans sought bigger homes with outdoor spaces for quarantining.

These numbers are based on signed contracts during the month, not closings, so it is perhaps the most up-to-date indicator in the housing market. Mortgage rates, which have been rising since January, really shot up in April. The average rate on the 30-year fixed loan began the month at 4.88% and ended it at 5.41%, according to Mortgage News Daily.

Consumers are being hit by rising interest rates and four-decade-high inflation. That is making it even harder for them to afford today's higher home prices. The median price of a new home sold in April was $450,600, an increase of nearly 20% from the year before.

"While new construction gained favor with many would-be buyers over the past two years due to the extreme shortage of existing homes for sale, the rising cost of a new home is now pricing many people out of the market," said George Ratiu, senior economist at Realtor.com. "The market for new homes is mirroring broader real estate trends, as rising inflation is taking a bigger chunk out of Americans' paychecks and surging borrowing costs are compressing homebuyers' budgets."

A stark pullback in demand, and not over-construction, is hitting the market.

ANALYSIS BY GO HOME TV

By R. Michael Brown, Go Home TV Producer

This report from CNBC is supported by news from the National Association of Home Builders (NAHB). In a sign that the housing market is now slowing, builder confidence took a steep drop in May as growing affordability challenges in the form of rapidly rising interest rates, double-digit price increases for material costs and ongoing home price appreciation are taking a toll on buyer demand.

Builder confidence in the market for newly built single-family homes fell eight points to 69 in May, according to the NAHB)/Wells Fargo Housing Market Index (HMI). This is the fifth straight month that builder sentiment has declined and the lowest reading since June 2020.

"Housing leads the business cycle and housing is slowing," said NAHB Chairman Jerry Konter, a builder and developer from Savannah, Ga. "The White House is finally getting the message and yesterday released an action plan to address rising housing costs that emphasizes a very important element long-advocated by NAHB - the need to build more homes to ease the nation's housing affordability crisis."

"The housing market is facing growing challenges," said NAHB Chief Economist Robert Dietz. "Building material costs are up 19% from a year ago, in less than three months mortgage rates have surged to a 12-year high and based on current affordability conditions, less than 50% of new and existing home sales are affordable for a typical family. Entry-level and first-time home buyers are especially bearing the brunt of this rapid rise in mortgage rates."

"The news is bad for the economy; but, there's a bigger issue here," said Dawn Pfaff, President of My State MLS and Host of Go Home TV. "Our country is short over 5 million homes. There aren't enough places for folks to live. We have never recovered from the 2008 housing recession and builders have been reluctant to build more and fast enough to make up the difference in demand. The current inflation and growing interest rates are curbing the pace to build more homes."

This will result in a lot of pressure on the public to find housing, especially affordable housing. The solution is to curb inflation and interest rate hikes so residents can afford to buy or rent homes and for builders to be able to respond to the demand to construct more housing at a more affordable and faster pace.