Market Trends with Real Estate Economist Ken H. Johnson

July 22, 2022

Go Home TV's Dawn Pfaff sat down with Ken H. Johnson, PhD, an economist and real estate researcher at Florida Atlantic University's (FAU) College of Business, to discuss the current and future market trends in key areas of the United States.

They covered:

- Top 100 U.S. Housing Markets - Pricing & Premiums with Historical Perspectives

- What a Municipality Should Do to Provide Future Real Estate Value

- One Year Market Predictions plus Long Term Trends

Video Transcript*

00;00;13 - 00;00;21 [DAWN PFAFF] Okay. So the top 100 U.S. housing markets. What about the 101st market?

00;00;21 - 00;00;43 [DR. KEN H. JOHNSON] We're not sure what the 101st market is because we measured by population and we did not examine past that. But if we if we rank them. In other words, if we ranked these top 100 markets, the city that's the least expensive is Baltimore, Maryland, which is selling for about a 2% premium right now. So it's darn near where it should be in terms of pricing.

00;00;43 - 00;00;53 Dawn So they didn't even get the what I call the big hit, you know, the wealth shot.

00;00;54 - 00;01;13 Dr. Johnson They did not in some cities, for example, they seemed to have learned from last time around [2007 - 2012]. And so people were saying, you know, I made the mistake. I overpaid and I lost a lot of money in housing the last time. And some cities seem to have learned this to a different degrees. So some cities that are surprising in our measures, there are Chicago and L.A..

00;01;14 - 00;01;20 Dr. Johnson I can't remember exactly. But there some come in coming in somewhere around 5, 10% premium.

00;01;20 - 00;01;34 Dawn So wait a second. Wait a second. So what you're telling me is Chicago, L.A., Baltimore. What did those three things have in common that those people didn't profit the way we did in Florida?

00;01;35 - 00;01;40 Dr. Johnson They were tremendously overpriced last time around and took a major hit, a major decline.

00;01;40 - 00;01;41 Dawn In 2008.

00;01;41 - 00;01;55 Dr. Johnson That's correct. Running all the way down bottom somewhere, depending on where you were in the country around 2012. Those cities took some of the largest hits. And think about it, if you're living in those cities, you're saying, fool me once, shame on you, fool me twice, shame on me.

00;01;55 - 00;02;07 Dawn Or what about supply and demand? What if people just would rather have left there than go there? Maybe that's what's causing the hit.

00;02;07 - 00;02;26 Dr. Johnson Well, but you're also saying that was the hit that's causing them to to move that that where they lost in terms of wealth creation, where they lost in terms of equity, people probably are leaving. Matter of fact, you can see this in those cities where there's outmigration or their growth expectation is very, very small. And so people are leaving.

00;02;26 - 00;02;33 Dr. Johnson They still have an inventory problem, which I think is propping them up a little bit right now. But you're not seeing tremendous overpricing there.

00;02;33 - 00;02;35 Dawn And what about New York City? What are you seeing there?

00;02;35 - 00;02;45 Dr. Johnson Well, the city our data actually comes from the whole metro New York. And that always confuses people because everybody's mind goes to Manhattan, all the boroughs.

00;02;45 - 00;02;46 Dawn And Long Island.

00;02;46 - 00;03;12 Dr. Johnson Nineteen and a half million people that live in metropolitan New York. So in New York, the overpricing is relatively low as well right now. Rents are high. Pricing is, relatively speaking, low. But New York also took a tremendous hit a decade plus ago. In a few markets, are the places that got hit the hardest. They've learned from that.

00;03;12 - 00;03;18 Dr. Johnson And they've said, you know, I just don't want to go through that again. So they bargain more aggressively and they're moving on.

00;03;19 - 00;03;34 Dawn I see what you're saying. So we are seeing, you know, a migration away from some of those cities because people have just said, hey, it's not worth overpaying here. Right? Either pay what it's worth or I'll just live somewhere else. Is that what you're saying?

00;03;35 - 00;03;48 Dr. Johnson I'm saying there's opportunities there and people are coming up and some areas have lost the appeal that they used to have. That's not saying I'm going to say this is it, finally for New York. People have been predicting the crash of New York.

00;03;48 - 00;03;48 Dawn It always comes back.

00;03;48 - 00;04;12 Dr. Johnson It always comes back to a great degree. But you're just not going to have the same economic punch that it had 20 years ago. And we've been seeing this evolution for years and years and years. The metropolitan area. Atlanta, Georgia. Dallas, Texas. Southeast Florida. Other cities around the country are gaining in terms of economic punch, if you will.

00;04;12 - 00;04;22 Dr. Johnson So much of the financial service business has relocated to Palm Beach County, Florida. Yeah, it seems like every day that we wake up and another hedge fund is moving into Palm Beach County, it seems.

00;04;22 - 00;04;31 Dawn I have to say the weather is pretty good [here]. I mean, I lived in New York my whole life and it's pretty cold.

00;04;31 - 00;04;34 Dr. Johnson I came here in part for the weather. Yes, in part for the profession.

00;04;34 - 00;04;47 Dawn The weather and the beautiful scenery. And you wake up every day and it's sunny, you know, whereas in New York it's not quite that way. But New York has an excitement that you cannot replace either.

00;04;47 - 00;05;08 Dr. Johnson New York is a world city, and it will not go away overnight. Not that it will ever go away, but there is on the margin reasons to live in South Florida or Atlanta, Georgia, as opposed to New York metropolitan area. And some people are taking advantage of that. And that's being reflected in the housing prices at this point in time.

00;05;08 - 00;05;11 Dawn You'd mentioned Detroit. What happened to Detroit?

00;05;11 - 00;05;37 Dr. Johnson So we're very worried about cities like Detroit, Memphis, Tennessee, Cincinnati, Ohio, in terms of their population. We pull from several data sources. Their populations are actually either declining or their growth rate is very, very small. As interest rates rise, housing prices will be forced down.

00;05;37 - 00;05;52 Dawn Oh, so you're seeing what I always say, all markets are local. I'm always telling everyone, markets are local. Which market? Pick a market. But when you talk about markets, you just mentioned Detroit. You mentioned Memphis. Why Memphis?

00;05;56 - 00;05;58 Dawn What other markets were like that?

00;05;58 - 00;06;01 Dr. Johnson Mostly in the Midwest.

00;06;03 - 00;06;26 Dr. Johnson Cincinnati, Minneapolis. So you're seeing these Midwestern markets. They are experiencing a significant amount of either a slower increase in population or to an outright decrease. I believe in Memphis. And again, please don't hold me to this number, but I think it's 1/10 of 1%. The population is expected to increase in the next ten years, 1/10 of 1%. That's not good.

00;06;26 - 00;06;27 Dr. Johnson That's not even the birth rate.

00;06;27 - 00;06;29 Dawn So that means people are leaving.

00;06;29 - 00;06;30 Dr. Johnson People are.

00;06;30 - 00;06;51 Dawn That's not the birth rate! Yeah, well, you had mentioned Boise, Idaho is the most overheated market. And that was a surprise to me because you don't, when you think of like great metropolises, you know, Boise, Idaho is not the first one you think of. So what other type of markets gained like that? That would be surprising?

00;06;51 - 00;06;54 Dr. Johnson So the Austin, Texas is number two.

00;06;54 - 00;06;59 Dawn That doesn't surprise me, though, because Austin, Texas, people talk about they love that place.

00;06;59 - 00;07;23 Dr. Johnson I think people love Boise is just not getting the same press level as Austin, Texas. But you can watch Austin, Texas along the trend and it barely was impacted by the crash a decade plus ago, and it stayed very close to its pricing trend for a number of years. And in recent years, though, it's just started to separate where people are moving in and massive numbers.

00;07;23 - 00;07;42 Dr. Johnson You have the inventory shortage. Prices are going up dramatically. So Austin, Texas, is in the top five cities that you would see in our top ten most overpriced markets. Somewhat surprising, would probably be Atlanta, Georgia. Charlotte, North Carolina is either just outside of or just inside.

00;07;42 - 00;07;57 Dawn Charlotte doesn't surprise me because of the banking industry. And there's so much growth. And the airport hub is in Charlotte.

00;07;57 - 00;08;01 Dr. Johnson Spokane, Washington is another one.

00;08;01 - 00;08;05 Dawn That does surprise me, Spokane, Washington are they coming out of Seattle? Where are they coming from?

00;08;06 - 00;08;11 Dr. Johnson It's seemingly different parts of the country, but mostly out of California.

00;08;11 - 00;08;12 Dawn California is going to lose population?

00;08;12 - 00;08;13 Dr. Johnson Absolutely.

00;08;14 - 00;08;19 Dawn Okay. So that's interesting. Do you think New York State as a whole is losing population?

00;08;19 - 00;08;26 Dr. Johnson I'm measuring metropolitan areas, not measuring the state. But it would not surprise me to see the state population go down.

00;08;26 - 00;08;34 Dawn Whole state population. So we're not just seeing from North to south because Spokane, Washington, that's from south to north.

00;08;34 - 00;08;36 Dr. Johnson Yes. Ogden, Utah, is another city.

00;08;36 - 00;08;40 Dawn Oh, I heard that was hot. I have a friend who is moving to Ogden. But you're saying you're seeing these things, right?

00;08;40 - 00;09;02 Dr. Johnson Yeah. And so I feel certain without doing the research that in these cities they spend a lot of time and effort and and money into producing grids that are technology friendly. So you can go there and you're going to be able to be productive. And I think that's going to be a big separation [from other areas].

00;09;03 - 00;09;26 Dr. Johnson If I was recommending what a municipality should do to give it the best chance for growth going forward, it would be invest heavily in technology, invest heavily in broadband. You need to be at real 5G. You need to be technology friendly and wi-fi capable all over your town. This is going to attract professionals to your area.

00;09;27 - 00;09;50 Dawn Okay, so let's do a little prediction on what we think is going to happen in the overall real estate market as a whole. I know I just said markets are local, but give me an up or down in the next year from today, are we going to be higher? Lower? Or are we going to ride this thing out?

00;09;50 - 00;10;08 Dr. Johnson Sure. So I think what we're going to find it is going to be what I might call a bifurcated outcome. There's two possible outcomes, both rents and home prices have separated so tremendously from their fundamental value. We can't do that without some sort of financial reckoning. So one of two outcomes seems the most likely.

00;10;08 - 00;10;11 Dawn I don't like the word financial reckoning. Well, hit me with it.

00;10;11 - 00;10;37 Dr. Johnson They're one of two outcomes, areas that are with the rise in interest rates, areas that are expecting a population decline or very moderate, modest increase in population will be hit the hardest in terms of pricing. And so what they will experience, I believe, cities such as Memphis and Detroit will actually see a significant downturn in prices. The other thing that's driving this is they're significantly overpriced.

00;10;37 - 00;10;51 Dr. Johnson They're pretty high up in our rankings. I don't remember exactly each of those two, but they're definitely top 25, 30ish, if you will, in those ranking. So they're very much overpriced. They're losing population and you're going to see that.

00;10;51 - 00;11;01 Dawn So here's how we do it. Okay? If you live somewhere that is overpriced and people are leaving, your housing values may drop. That's what we're saying?

00;11;01 - 00;11;01 Dr. Johnson That's correct.

00;11;01 - 00;11;04 Dawn Okay. So don't buy rental property [in these markets]. That is what we're trying to say?

00;11;04 - 00;11;06 Dr. Johnson That's probably true.

00;11;07 - 00;11;32 Dr. Johnson That's the other outcome besides a crash. If you're in an area where you're having significant influx of population and this inventory shortage is going to persist, it was a decade plus in the making. It's not going to go away in the next year. We're not going to see a housing crash. What we're going to experience, so we'll have to pay for it in this period, a prolonged period of housing unaffordability, both in rents and prices.

00;11;33 - 00;11;34 Dawn What we're going to have to pay for.

00;11;35 - 00;11;38 Dr. Johnson The trade off. People are always looking for trade offs.

00;11;38 - 00;11;39 Dawn Yeah, the trade off.

00;11;39 - 00;12;13 Dr. Johnson The trade off is because we have separated so significantly from fundamental prices and home prices. Fundamental monthly rentals. It's either going to be prolonged unaffordability, which you'll see in places like Miami, places like Atlanta, Georgia, Dallas, Texas. Absolutely. Or you'll see a housing crash in areas such as Memphis or Detroit, possibly Chicago, where you're seeing the slowdown in population and the inventory situation.

00;12;13 - 00;12;17 Dr. Johnson You're going to see prices decline in those areas.

00;12;17 - 00;12;42 Dawn That is exactly what I've been saying. That, first of all, from 2008 to just about 2018, we had a huge shortage of inventory of new construction because the market was so hammered, it was hard to get money. People didn't want to buy because they didn't want to take the risk. It takes like seven years to get a project approved anyway, right?

00;12;42 - 00;13;04 Dawn So we had this huge shortage building up in certain areas and then we throw this pandemic on top where people are like, I'm out of here because, you know, I'm living in a shoe box with six other people and paying $5,000 a month for it. So let me go somewhere that's a little cheaper. And they were cheaper, but now it's not cheaper there anymore because they brought their money.

00;13;07 - 00;13;24 Dr. Johnson But it still might be less expensive than where you were before, in absolute terms, 100%. And relative to your income, many of the people that are coming here are bringing their jobs with them. They're not packing up, moving to Florida and looking for jobs. They're bringing their profession with them.

00;13;24 - 00;13;37 Dawn It's so amazing to me that for some people, obviously not surgeons or whatever, that you can just pick up and take your job with you.

00;13;38 - 00;13;39 Dr. Johnson To a great extent.

00;13;39 - 00;13;48 Dawn Yes, anyone who really worked in an office who really didn't work directly with the the public in that location, they pretty much could just pick up and go.

00;13;49 - 00;13;49 Dr. Johnson And you're seeing that.

00;13;49 - 00;14;06 Dawn Yeah, you're definitely seeing that. And even though people want you to return to your office, I think that the employers, because of the employee shortage or the talent shortage, they're living with it. They're like, Oh, I [want to] work from home.

00;14;06 - 00;14;18 Dr. Johnson That's correct. You're definitely seeing outside of extending beyond real estate, we're definitely seeing a shift in power, if you will, between management and employees.

00;14;19 - 00;14;30 Dawn Yeah. All right. So that shift in power that is going to affect the housing market. Absolutely, as well. That's correct. Yeah. And the commercial market, you guys study the commercial?

00;14;30 - 00;14;31 Dr. Johnson We don't do commercial.

00;14;31 - 00;14;34 Dawn But does the commercial market pretty much follow the housing market?

00;14;34 - 00;14;51 Dr. Johnson It has historically done that. But we have reason, and I don't do research directly in this area, that correlation and is perhaps going to be broken this time simply because we have so much commercial space.

00;14;51 - 00;14;59 Dawn And the work from home. What happened? You know what I keep saying that they should reconfigure some of this commercial space into affordable housing.

00;14;59 - 00;14;59 Dr. Johnson We're seeing that.

00;14;59 - 00;15;36 Dawn So thank you so much for that. It was great!

Dawn: Thank you for joining us here today at Florida Atlantic University, the College of Business. If you enjoyed this discussion that we had with Dr. Ken Johnson, you can find out more information about the indexes they compile and all the information and research that they do on Go Home TV on MY State MLS. Go to the Go Home TV section and look for the article.

*This video transcript has been software generated and not fully edited.

Related Content

MyStateMLS

MyStateMLS.com

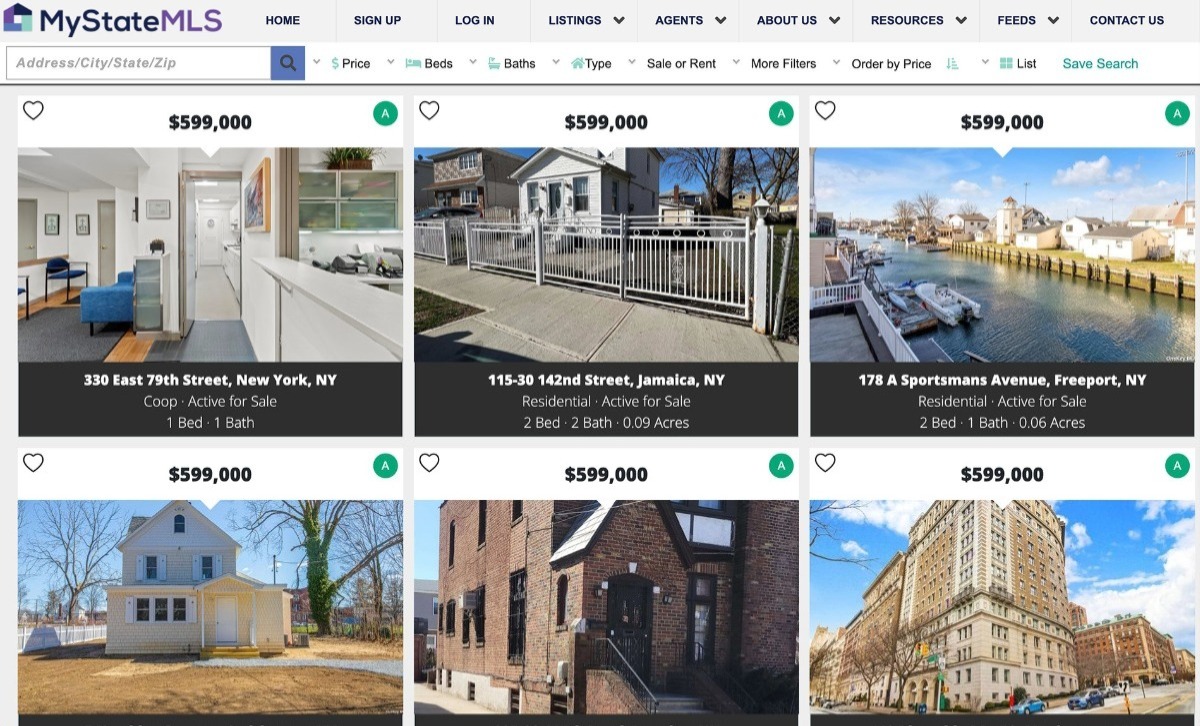

Real Estate Markets Nationwide

Real Estate Market Research