Media & Industry Create False Rumors about Housing Market

Getty Images

August 30, 2022

By R. Michael Brown, Go Home TV Producer & VP Marketing and Communications My State MLS

The facts are getting in the way of the media and industry rumors that the real estate market is dead, dying, or heading into a recession.

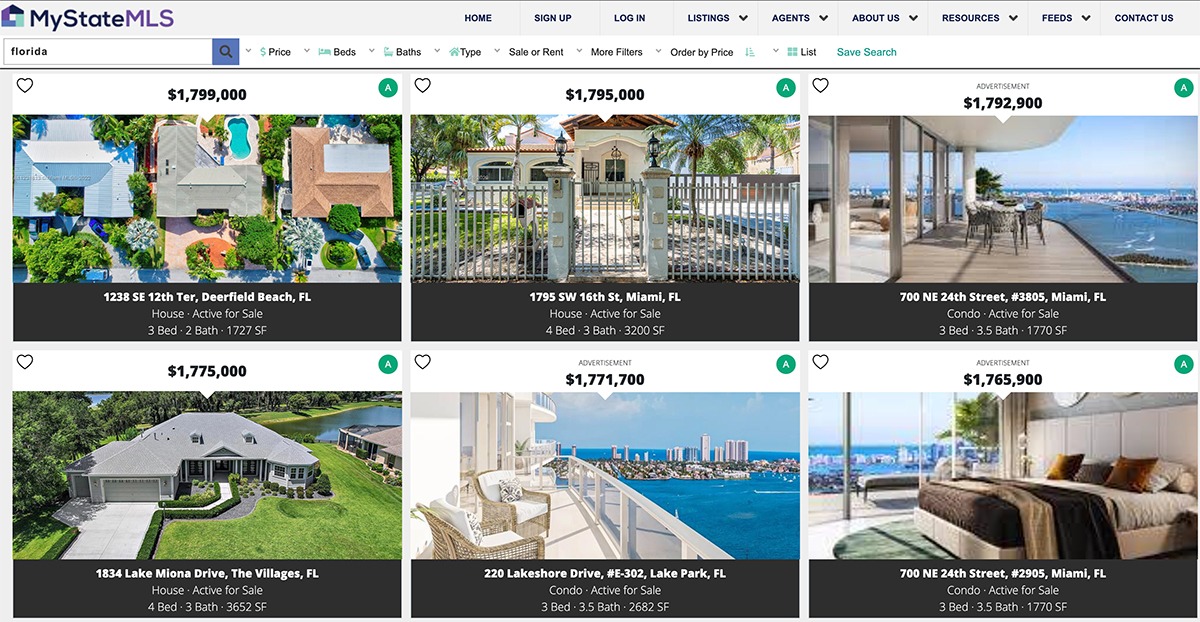

"It's our forecast that the real estate market will start getting back to what it was like before the pandemic," said Dawn Pfaff, President of My State MLS - the nationwide multiple listing service. "What we've had over the last couple of years has been a national market that was reacting to unusual pressures - population movement and construction material supply interruptions because of COVID, and a growing population and more cash buyers causing ever increasing demand. In addition, new home construction has never recovered from the housing crash in 2008. We're millions of homes behind in needed new homes."

That drove housing supply way down and prices way up - a mostly pandemic based housing boom.

Now, with inflation running at 40-year highs and interest rates increasing to between 4% and 6%, housing price growth is slowing in most markets and is flat or reducing in a few markets.

"That doesn't mean that the real estate market is in the trouble that so many pundits are pushing," said Pfaff. "It just means that the overall market is reaching a balance between a seller's market and buyer's market. Yes, the frenzy is over, and inventory isn't as good as buyers would like. But the crazy market wasn't sustainable. And since when is a 5%, 30-year fixed mortgage, not a reasonable interest rate?"

The peak of the market and the resulting balance will cause sellers to put their homes for sale and real estate agents will list them, show them, and sell them to willing buyers in a reasonable amount of time, over months instead of days and without bidding wars. Sounds like the normal real estate market, doesn't it?

When a market has overheated price growth and prices decline some, not to the levels below the start of the overheating, how is that suddenly a recession?

Let's look at the facts. As always, all markets are local.

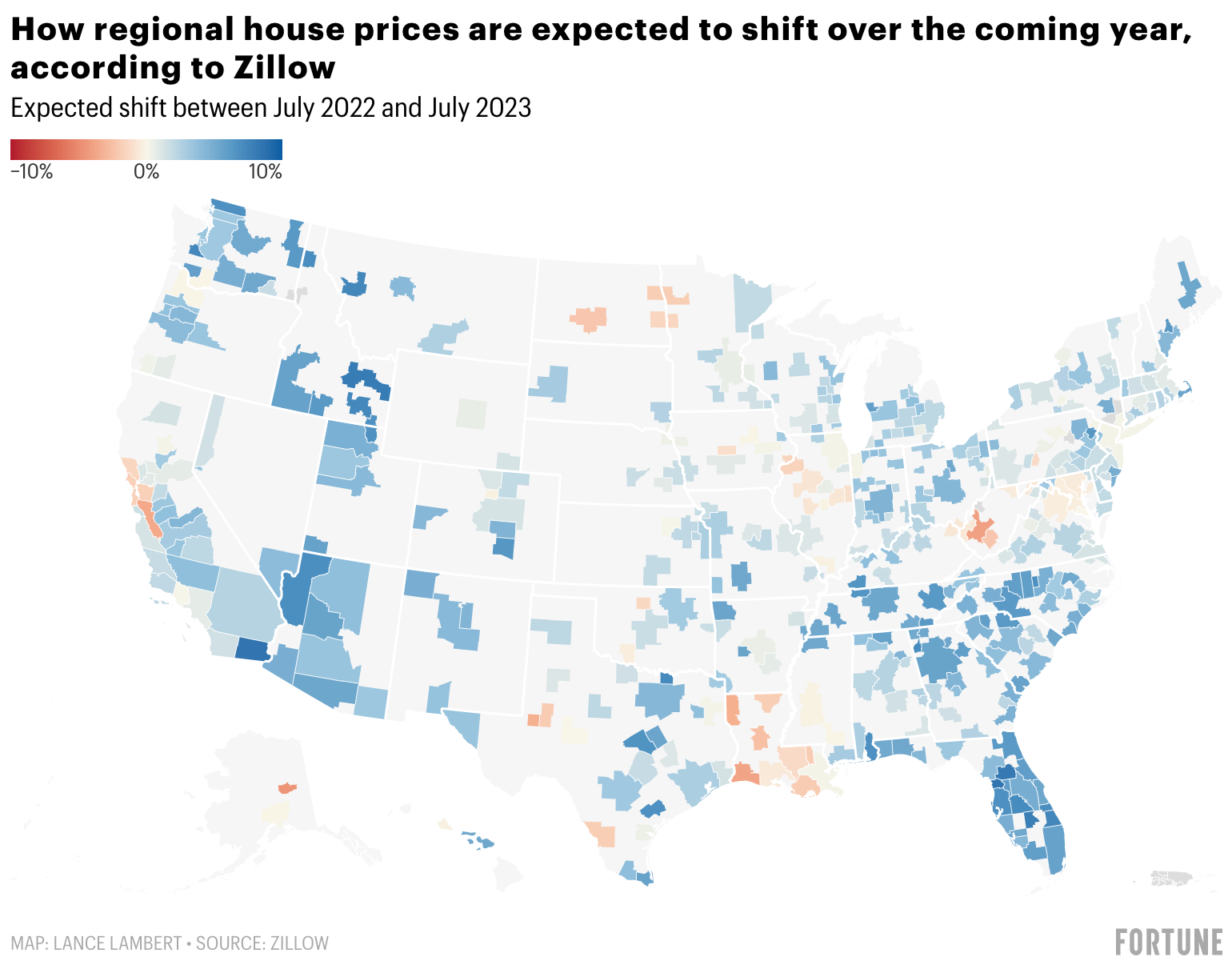

Zillow economists analyzed 911 regional housing markets this month and found that 780 markets are poised to see higher home prices over the coming year. Of those, 140 markets are poised to see a 5% or greater home price growth. That includes markets like El Centro, Calif. (8.5% forecasted growth); Homosassa Springs, Fla. (8.4%); Ocala, Fla. (8.2%); Idaho Falls, Idaho (8%); Sebring, Fla. (7.8%).

In the regional house price forecast map above, blue is housing price increases from July this year to July 2023, gray is flat prices, and orange/red is forecast price reductions. There's an awful lot of gray and blue on this map. Not much red. How's that a housing recession?

One of the best housing forecast indicators to watch is inventory. If prices are going to fall, the market will have a big growth in inventory. With more supply, prices drop. While nationally active listings on Realtor.com jumped 128,200 last month to 747,500, a sizable increase.

"A normal market has about 2 million active listings," said Pfaff.

When it comes to 2023 housing forecasts, there is no consensus. Firms like CoreLogic, Fannie Mae, Freddie Mac, and Zillow are all still forecasting positive home price growth. Firms like John Burns Real Estate Consulting, Zonda, and Zelman & Associates are all predicting falling home prices over the coming year. Famed economist Robert Shiller predicted the last housing bubble and thinks U.S. home prices could fall 10%.

That statement of falling 10% needs some context because taken by itself it's misleading and fuels the rumors. Let's have some common sense here.

If your house appreciated 28% in the last year, and its price drops by 10%, you're still ahead 18% in 1 year. Where's the panic?

The market is normalizing.

Some housing experts say the market is in a correction after "unsustained and unprecedented" growth. That's our view too.

Home prices appear to have peaked in a growing number of U.S. markets, according to a July analysis by researchers at Florida Atlantic University (FAU) and Florida International University (FIU). FAU's Ken H. Johnson, Ph.D., and FIU's Eli Beracha, Ph.D., rank the 100 most overvalued housing markets by analyzing their premiums - the percentage above the long-term pricing trend that consumers must pay in order to buy a property. The larger the premium, the more overpriced the market.

In July, premiums declined from June in 27 markets, mostly west of the Mississippi River, and 22 of the 27 also experienced price declines. The following were among the metros with falling premiums and average prices: Austin, Texas; Denver; Minneapolis; Los Angeles; Phoenix; Salt Lake City, Utah; San Francisco; and Seattle.

In June, premiums declined in 12 markets and average prices fell in seven. A falling premium is a classic sign of a home price peak, according to Johnson, an economist in FAU's College of Business.

"The consistent increase in the number of premium downturns in our monthly reporting strongly suggests that individual housing markets are at, or will soon be experiencing, their pricing peaks," said Johnson. "We are at the turning point. The likelihood of significant price increases in the near future grows smaller by the day."

But the data also shows that prices are still up in most of the markets, Beracha said. He doesn't expect home values to fall sharply across the board, as they did during the last housing downturn of 2006-2011.

"There simply is not enough inventory to go around," said Beracha, of FIU's Hollo School of Real Estate. "That undersupply will keep pressure on prices in many areas."

The most recent figures reveal that Boise, Idaho, remains the nation's most overvalued market, with buyers paying 66.73 percent above the long-term pricing trend. Austin, previously the second most overvalued market, has been surpassed by Las Vegas and Fort Myers. The Sunshine State also has two other metros, Lakeland and Tampa, in the top 10.

The full rankings with interactive graphics can be found here. [FAU College of Business]

The researchers study markets' long-term pricing trends going back to 1996, and the data covers single-family homes, townhomes, condominiums and co-ops.

Johnson and Beracha believe the severity of the U.S. housing slowdown will vary across the nation.Markets with continuing inventory shortages and spiking populations likely won't face huge price declines. But that means affordability will be persistent in those areas, including metros in Florida, Georgia, and North Carolina.

Markets with stagnant or declining populations and more homes for sale, such as metros in California, Oregon and Washington, could experience major price declines. But that also would make properties there more affordable for buyers currently priced out of the market.

"Will prices decline quickly and noticeably or will we see the nation's inventory issues support prices at the expense of a prolonged period of housing unaffordability?" Johnson said. "This will all depend on population movements and how fast we build much-needed housing units."

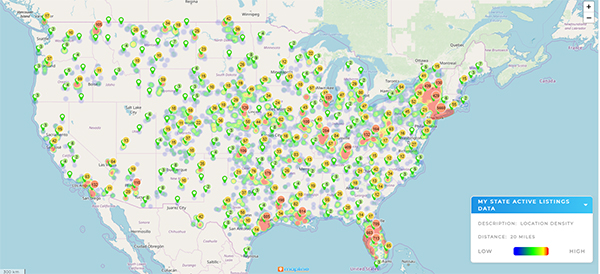

"The real estate market overall should be friendlier to buyers," said Pfaff. "At least compared to the brutal pandemic housing boom. Our active listings are growing on My State MLS. [As shown on the listing heat map below] We expect that trend to continue."

My State MLS growing active listings

"We are coming from a housing market where buyers had no negotiating power. It was the ultimate seller's market," Ali Wolf, chief economist at Zonda, told Fortune Magazine. "What appears to have changed is a shift in power. We are finally seeing some metros turn buyer-friendly and other areas straight-up return to a buyer's market."

Reasonable real estate professionals know that all markets are local, that the media and pundits tend to push extremes - which can cause a self-fulfilling prophecy. It's time for the industry and consumers to listen to the sensible real estate pros and make property decisions based on real data, not rumors or wild speculation.